If you’ve been following us, you know that redeeming Travel Rewards is one of the core strategies we use to travel the world for less than staying at home in the US. In this blog post, we’ll revisit the basics of travel rewards, share our 2024 earnings and redemptions, highlight the credit cards we opened, and show you how much we saved. We’ll also give you a peek at what we’re planning for 2025.

Introduction to Travel Rewards

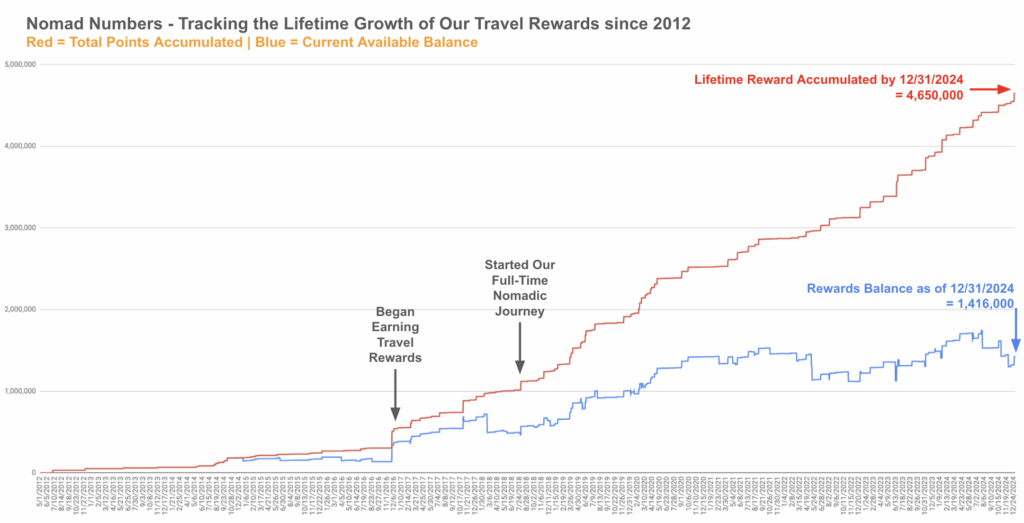

Our Travel Rewards Balance continues to grow in 2024, proving how effective this strategy is! Travel Rewards (also known as “Credit Card Rewards” or “Travel Hacking”) is all about opening specific credit cards to earn large sign-up bonuses in the form of travel points, hotel points, or airline miles. You can redeem these points to fund flights, hotel stays, and more.

Types of Travel Rewards

- Airline or Hotel Rewards: From co-branded cards like Delta SkyMiles or Chase United Explorer.

- Fixed Value Rewards: Points have a set value and can often be applied to erase travel purchases.

- Transferable Rewards: The most flexible and valuable, allowing transfers to a variety of airlines and hotels. (e.g., Chase Sapphire Preferred, Capital One Venture X)

Important: Travel rewards only work if you pay your balance in full every month, have good credit, and can handle a small, temporary dip in your score.

How to Maximize Travel Rewards

If you are new to travel reward, please check out our How to fly around the world for (almost) free: our ultimate guide to Travel Hacking.

Detailed List of Travel Rewards Earning and Redemptions 2024

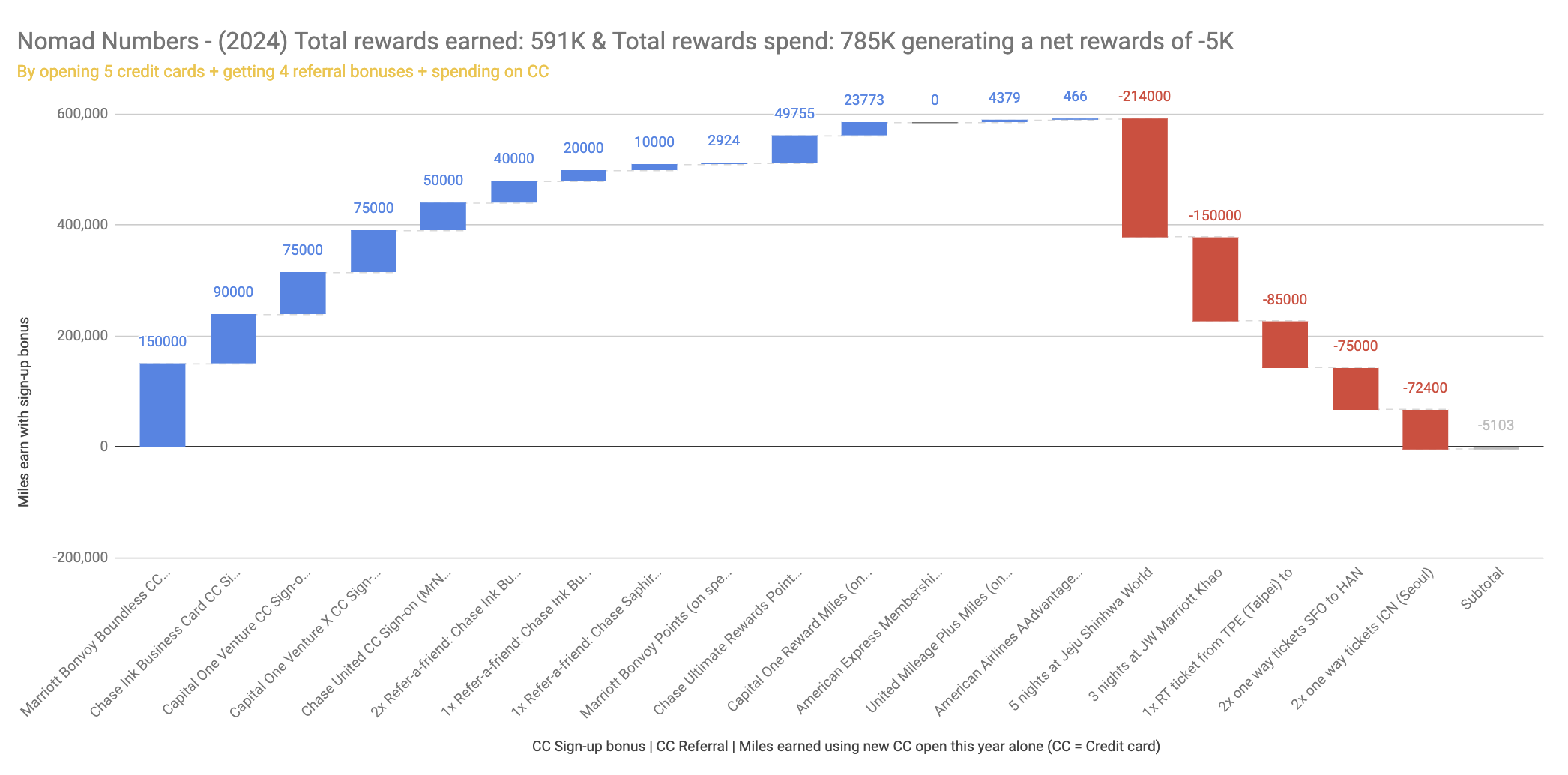

Let’s break down exactly how much we earned and redeemed in 2024 so you can see just how valuable this strategy can be in practice. Here is the overall summary:

2024 Travel Rewards Earnings

In 2024, we redeemed 596,400 points for an estimated value of $5,800, paid just $264 in fees, and ended up with a net savings of $5,536 using the following techniques (listed by order of preference):

- Sign on bonuses: we accumulated 5 sign-on bonuses between the two of us which have an estimated cash value of $5,800.

- Referral bonuses: we scored an easy $628 thanks to four CC referral

- Credit card spend: we earned an estimated cash value of $860 from using our credit cards.

| Credit Card | Sign-up Bonus | Min Spend | Time Limit to reach the spend to earn the bonus | Bonus Estimated Cash Value (USD) |

|---|---|---|---|---|

| Marriott Bonvoy Boundless (MrsNN) | 150,000 pts | $3,000 | 90 days | $1,050 |

| Chase Ink Business (MrsNN) | 90,000 pts | $6,000 | 90 days | $1,845 |

| Capital One Venture (MrsNN) | 75,000 pts | $4,000 | 90 days | $1,388 |

| Capital One Venture X (MrNN) | 75,000 pts | $5,000 | 90 days | $1,388 |

| Chase United (MrNN) | 50,000 pts | $3,000 | 90 days | $625 |

| Referrals (both) | 70,000 pts | N/A | N/A | $955 |

| Spend Bonuses (both) | 80,297 pts | N/A | N/A | $1,546 |

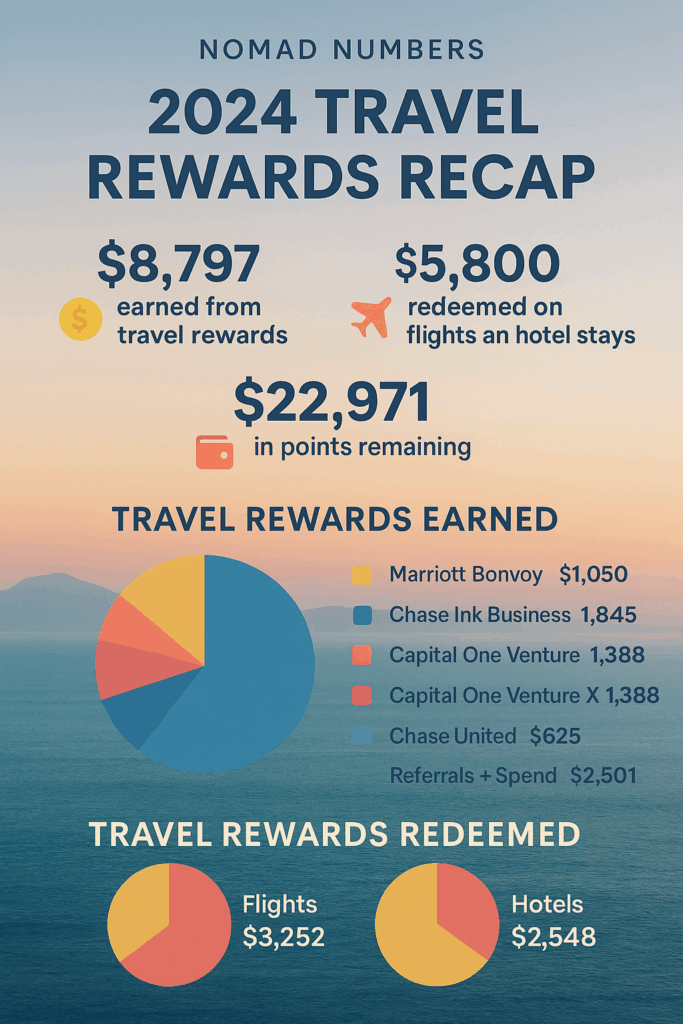

In 2024, we earned 591,297 points, with an estimated total value of $8,797.

Bonus Estimated Cash Value is based on the value of the reward using the Points Guy valuation’s page (as of December 2024).

2024 Travel Rewards Redemptions

In 2024, we redeemed 596,400 points for an estimated value of $5,800, paid just $264 in fees, and ended up with a net savings of $5,536.

| Redemption | Points Used | Any additional cost to claim the redemption | Estimated Reward Value (USD) |

|---|---|---|---|

| 5 nights at Jeju Marriott | 214,000 Marriott | $0 | $1,498 |

| 3 nights at JW Marriott Khao Lak | 150,000 Marriott | $28 | $1,050 |

| RT Flight TPE-GVA (Delta + AA) | 85,000 Miles | $117 | $1,150 |

| 2x One-way SFO-Hanoi (AA) | 75,000 Miles | $43 | $1,125 |

| 2x One-way ICN-SFO (United) | 72,400 Miles | $76 | $977 |

Estimated Reward Value is based on point valuations from The Points Guy (as of December 2024) and may differ from the actual cash value of our redemptions.

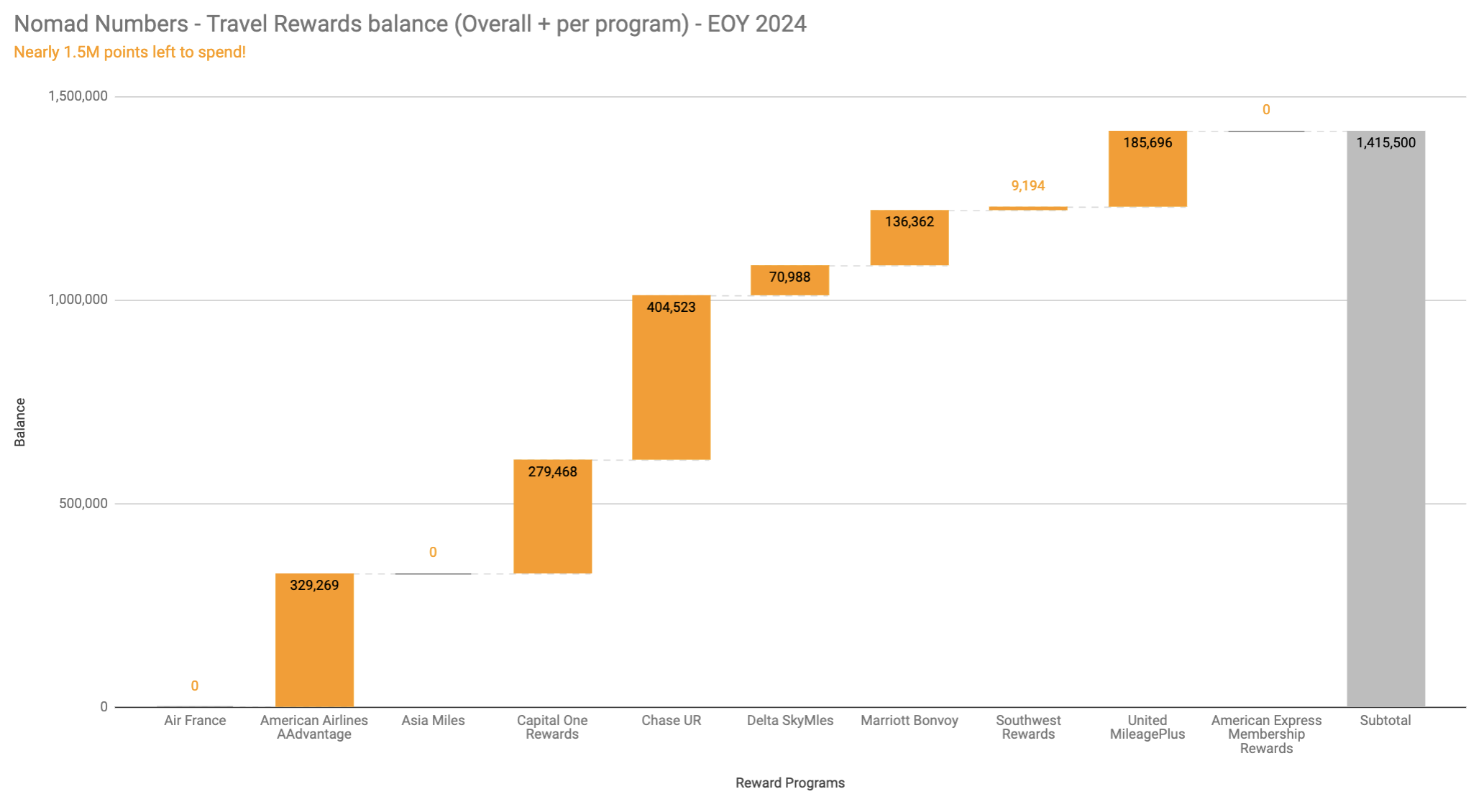

How much rewards do we still have left to spend in 2024?

As of December 31th, 2024, we’ve earned a total of approximately 1.4 million points, with an estimated value of around $22,971.

| Program | Balance | Bonus Estimated Cash Value (USD) |

|---|---|---|

| Chase Ultimate Rewards | 404,523 | $8,292.72 |

| Capital One Rewards | 279,468 | $5,170.16 |

| AA AAdvantage | 329,269 | $4,939.04 |

| United MileagePlus | 185,696 | $2,507.90 |

| Delta SkyMiles | 70,988 | $887.35 |

| Marriott Bonvoy | 136,362 | $954.53 |

| Southwest Rewards | 9,194 | $119.52 |

Recommended Credit Cards for Earning Travel Rewards

We highly recommend that you start with the top Chase card, the Chase Sapphire Preferred, to plan for the 5/24 rule. The Chase Sapphire Preferred has a much more approachable annual fee to get started than the Chase Sapphire Reserve. It’s also a great first credit card for travel rewards because the points are transferrable as cash value on their portal or can be transferrable to many partner airline and hotel programs.

If you already have this card and are looking for other suggestions, please check out our Credit Cards page where we put the latest credit cards offers we’ve been recently using. And if you’d like to stay updated on our finds, we suggest that you sign-up for our newsletter where we share the latest offer from the cards we’ve been recently opening.

Our bottom line

In 2024, travel rewards helped us save over $5,500 and bank more than $22,000 in future travel. We’re grateful for the freedom this strategy provides and excited for what’s ahead.

If you’re just getting started, know that it’s possible—and we’re here to help. Drop us a comment, share your best redemptions, or ask us anything below!

Happy safe & free travels,

0 Comments